Transporter ID Enrolment: How to Register on the Eway Bill Portal?

With the new guidelines in regards to transport of goods in place and the requirement for e-way bills, it is important that transporters know about the provisions in regards to the same.

Most recent Update as per the 26th GST Council Meet hung on 10th Mar 2018

Intra-state execution of e-way bill to be actualized from first April 2018

Intra-state execution of EWB to commence from fifteenth April 2018 out of a staged way. States to be partitioned into 4 parcels to execute this staged rollout.

What is Transporter ID?

Transporter ID is a 15-digit special recognizable ID number assigned to an unregistered Transporter enabling generation of e-Way Bills.

Why is transporter ID required?

Transporters need to create the e-way charge if –

A) Value of dispatch is more than Rs. 50,000

or

B) Value of all goods moving through a solitary vehicle is more than Rs. 50,000

Indeed, even the unregistered transporters under GST need to take note of that e-Way Bills are required to be created by them under the above conditions.

Since an unregistered Transporters won't have a GSTIN, the idea of Transporter ID had been presented.

Where and when to utilize the Transporter ID?

Unregistered Transporters need to specify this ID on each e-Way Bill set up of GSTIN.

Transporters give this number to the providers/dispatcher to specify it on the e-way charges produced by them which thus empowers the transporter to refresh the vehicle number later for developments of products.

How to get the Transporter ID?

Each unregistered transporter will be issued a Transporter ID on selecting themselves on the EWB entryway.

By doing enrolment on e-Way Bill gateway, the accompanying are the result:

I) The transporter gets an extraordinary Transporter ID

ii) An interesting Username to work on the e-Way Bill gateway

Here is the well ordered process for enrolment on the e-Way Bill gateway by GST unregistered transporters:

Step-1: Visit the e-Way Bill entrance.

Step-2: Click on ‘ Enrolment for transporters ’ under Regsitration tab available on Home page.

Step-3: Enter the details in the Application at points 1-9 and Click ‘Save’

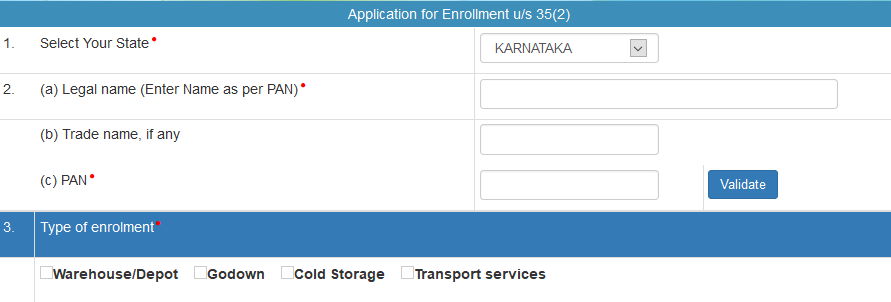

Let’s go through the entire ‘Application u/s 35(2)’ in GST ENR-01 for each of the 9 points:

Note that the fields marked (*) in red are mandatory

1. Select Your State*

2. a) Enter Name as per PAN*

b) Enter Trade name if any

c) Enter your PAN*

(Note that once you enter PAN and click on Validate, system validates for any error of mismatch, rectify the same and proceed)

3. Type of enrolment*:

Note: The System does not allow you to proceed here without entering the details at point 1 and 2.

Select the relevant type- warehouse/godown/cold storage/transport service

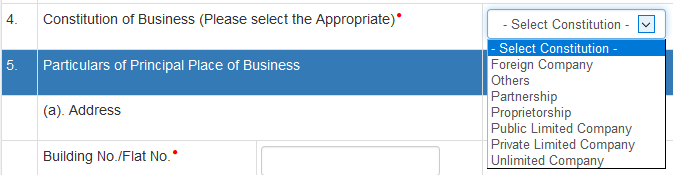

4. Constitution of business*:

Select the relevant business form from the drop down-

Foreign company/Partnership firm/ proprietorship/ Private limited company/ public limited company/Unlimited company/ others( If HUF, AOP, BOI and so on)

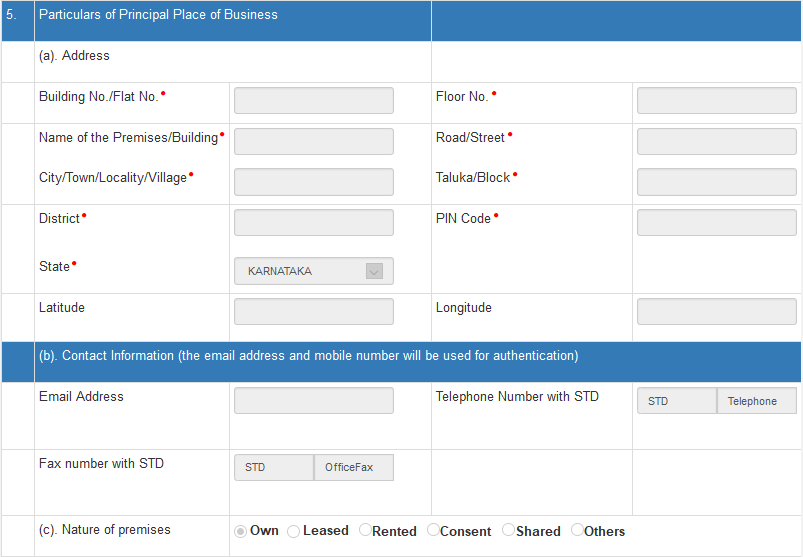

5. Principal place of business

a) Type in the Complete Address entering all the red marked mandatory fields.*

b) Contact information: Type the e-mail address, Landline number and Fax number (if any)

Note: The e-mail address mentioned here shall be used for authentication.

c) Nature of premises mentioned at a)- Select whether the address at a) is Building that is Own /leased /rented/ consent/ shared/ any other case.

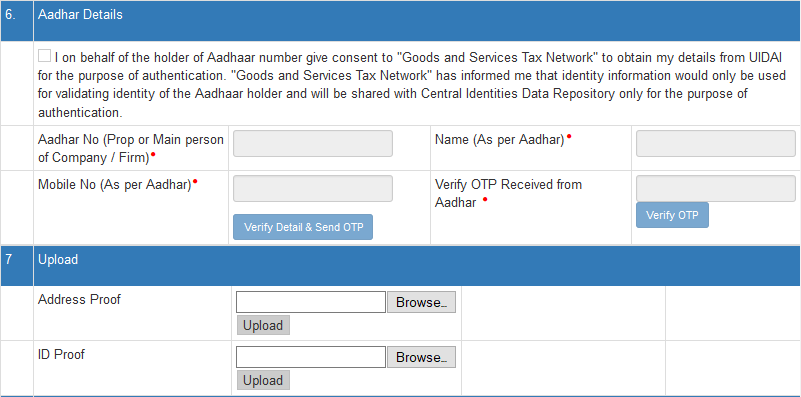

6. Aadhar details and verification for authentication of the application* :

Tick mark on the left-hand side box to give your consent to the e-Way Bill System/GSTN to fetch Aadhar details of the Authorised personnel of the organisation from UIDAI for authentication here.

In the fields that follow, Mention the following with respect to the authorised personnel of the Company/ the Proprietor/ the partner of the firm:

The Aadhar Number, Name of the personnel and mobile number as per Aadhar.

Once entered, Click on ‘Verify detail & Send OTP’ button.

An OTP is sent to the Mobile number registered with Aadhar of the above-mentioned personnel.

Enter it and click on ‘Verify OTP’

A message that Your Aadhar was successfully verified appears.

7. Upload: Click on ‘Browse’ and select valid documents from your system (one for address proof and one for ID proof) in PDF and click on ‘Upload’.

System pops an error message if not uploaded correctly, then make the change to the file accordingly and upload once more.

If correctly uploaded, then the file name appears on the right-hand side of each field.

8. Create Login details* :

Set a new unique username/ user ID and password.

Check if the username you wish to set is already being used or not by clicking on ‘Check’.

9. Verification* : Tick mark against the declaration confirming the correctness of the Information you give and Click ‘Save’

Outcome: System generates a 15-digit Transporter ID and displays the same. Note this number and inform clients.